Home » News & Events » Economic Impacts of Wind Industry

Economic Impacts of Wind Industry

Overview

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no different. Typically, a proposed wind project will affect a community in several ways. Whether any single impact is viewed as a benefit or a drawback depends on the perspective of the stakeholder.

In considering whether to support the development of a wind farm, it’s up to the community to decide if the positives outweigh the negatives. To do that, the community must understand the potential economic impacts of wind energy projects and issues related to local economic activity, land revenue, property taxes, and property values.

Local Economic Activity During Planning, Construction, and Operation

Wind power projects can help diversify, strengthen, and stabilize local economies at the municipal, county, and State level. Increased economic diversification helps improve economic stability by minimizing high and low financial cycles associated with a specific industry. This effect can be particularly important in rural areas, which tend to have a one-dimensional economy, such as agriculture. Additionally, due to the high labor-to-capital ratio, wind projects can add value to the local economy without creating a substantial burden on local and State infrastructure, such as the existing water and sewer system; transportation network; or emergency, education, and other public services.

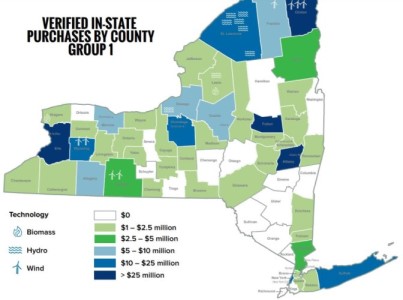

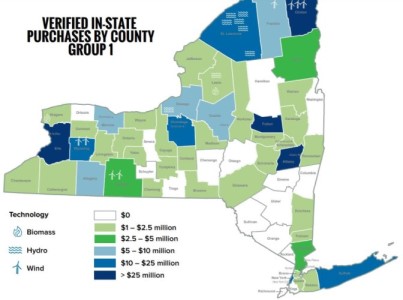

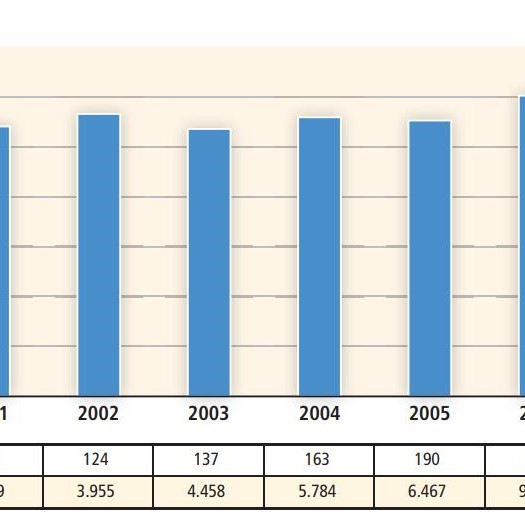

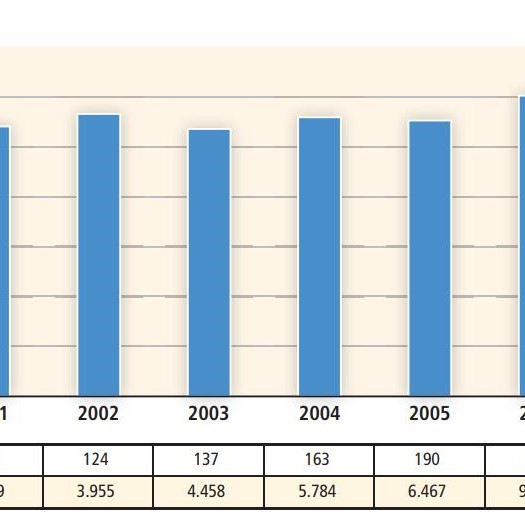

In 2013, the New York State Energy Research and Development Authority (NYSERDA) released a study 1 that analyzed the economic benefits resulting from New York State’s Renewable Portfolio Standard (RPS). This study analyzed three years of spending from 18 renewable energy facilities under contract to NYSERDA (including two biomass facilities, eight hydroelectric facility upgrades, and eight wind farms) and extrapolated direct investments over the lifecycle of the project. The research examined verified spending on jobs; payments to public entities; in-State purchases; and land leases for these facilities, from development and construction through the first three years of operation.

As shown in figure , the geographic and economic impacts of these projects are often concentrated around the project location, but also extend beyond the counties where the projects are located. More than 1,000 in-State businesses spread over 44 counties benefited from the development, construction, and operation of these 18 facilities.

The study found that every megawatt-hour (MWh) of renewable energy generated under the RPS resulted in approximately $27 of direct investment (NYSERDA 2013). The bulk of the energy production and spending came from the wind farms, which included direct investment of $1 million/megawatt (MW) installed and $24/MWh for the eight projects analyzed.

Land Revenue

The development of a wind project can provide an additional source of income to rural land owners from leasing and royalty agreements. Since only a fraction of this land is utilized by physical plant structures and roads, the previous use of the land (e.g., farming or dairy operations) can continue alongside the wind power facility.

Depending on the placement of turbines on one or more properties, the project may directly benefit one or more landowners through lease payments and production royalties. In addition to these direct benefits, the broader community may benefit. This is due to multiplier effects associated with the increased income of the host landowners and long-term stability of those landowners, who have diversified their sources of income.

Property Taxes and Host Community Agreements

Wind energy projects typically contribute to local government revenues through tax collections or other local benefit agreements. When considering the different approaches or mechanisms used to establish payments to local governments, the magnitude of the payments should be comparable to the costs associated with additional services required by the project, while providing a reasonable benefit to the larger community. For many small towns, payments from wind energy projects result in a significant increase in revenue compared to other local revenue sources.

Some jurisdictions have limited or exempted local taxation of wind energy projects to induce development and increase economic diversity. Other forms of stimulus may include business or corporate incentives for establishing manufacturing or company headquarters in a region or state.

Wind Project Exemption

Payment of additional property taxes on improvements associated with wind turbines is exempt for a period of 15 years, unless opted-out by the local taxing jurisdiction (New York State Real Property Tax Law, §487). The current exemption law is set to expire on December 31, 2024. The exemption is at the discretion of the local taxing jurisdiction—while local taxing districts have generally granted the exemption, this has not always been the case.

Payments-in-Lieu-of-Taxes

County, city, town, village, and school district taxing jurisdictions that do not retract the exemption may enter into an agreement for payments-in-lieu-of-taxes (PILOTs) with the owner of the wind turbine equipment (project owner). PILOT agreements are common practice in all types of development projects, not just wind energy. Several taxing jurisdictions can be parties to the same agreement—each taxing jurisdiction does not have to enter into its own PILOT with the project owner. If multiple jurisdictions are parties to the agreement, the PILOT agreement defines the amount the project owner pays each taxing jurisdiction. Frequently, the county Industrial Development Agency (IDA) negotiates the PILOT on behalf of the relevant taxing jurisdictions. The agreements may be written by the county or local taxing jurisdiction’s tax counsel.

The payment amount is paid in lieu of property taxes due on the equipment and improvements to the land. PILOT amounts cannot exceed the amount that would be due if property taxes associated with the improvement were not exempt and the agreement cannot continue for more than 15 years. PILOT agreements negotiated through the county IDA can exceed this 15-year term. PILOT agreements cover the amount to be paid and how it is distributed among the different parties to the agreement, but do not include language on how these funds may be expended. After the agreement expires, the wind project owner is responsible for paying the property tax assessment required by the taxing jurisdictions. Wind project developers and taxing jurisdictions may want to estimate the potential future property taxes after the agreement expires, so wind developers and taxing jurisdictions can plan accordingly.

Property Value

Property owners often want to understand how a wind project will impact their property value. Depending on their involvement with a wind project, property owners usually have different concerns:

In general, only limited research on the impact of wind farms on property values is available. Such research examines trends in sales transactions. Data and studies for homes that are adjacent or are less than 0.5 miles from a wind project are rare. Because most large-scale wind farms are subject to setback requirements ensuring they are built a certain distance from neighboring properties, wind facilities are generally sited in areas with relatively few homes, limiting the number of sales transactions that are available for research (Hoen, Wiser, & Cappers, 2013).

The existing research examining the property values of residential homes located near or with views of wind turbines provides little or no evidence that home values are affected (positively or negatively) before or after the construction of facilities. For example, a study conducted by Hoen et al. in 2013, analyzed data from more than 50,000 home sales across 27 (mostly rural) counties in nine states including seven counties7 in New York that were within 0.5 to 10 miles of wind facilities. The study found no statistically significant evidence that home prices near wind turbines were affected in post-announcement, preconstruction, or post-construction periods. The study concluded that if effects do exist, the average impacts are relatively small (within the margin of error for the report, which was +/- 4.9% for homes within 1 to 10 miles, and +/- 9% for homes within .5 miles from a wind facility) and/or sporadic, impacting only a very small subset of homes.

A similar 2014 study examined 122,000 homes sales near 41 turbines located in more densely populated areas in Massachusetts within five miles of wind facilities. The study concluded there were no net effects on property values due to wind turbines. The study found only weak statistical evidence that the announcement of a wind facility had a modest adverse impact on home prices, and such impacts were no longer apparent after turbine construction and operation commenced (Hoen & Atkinson-Palombo, 2014).

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no different. Typically, a proposed wind project will affect a community in several ways. Whether any single impact is viewed as a benefit or a drawback depends on the perspective of the stakeholder.

In considering whether to support the development of a wind farm, it’s up to the community to decide if the positives outweigh the negatives. To do that, the community must understand the potential economic impacts of wind energy projects and issues related to local economic activity, land revenue, property taxes, and property values.

Local Economic Activity During Planning, Construction, and Operation

Significant economic impacts of the wind industry include payments to local landowners, short- and long-term job creation, and spending on goods and services in supporting industries. All phases of wind development bring increased economic activity to the local area. During the planning stage, this may include easement and lease payments to residents, legal services, and environmental and engineering work. The construction phase usually brings a large number of short-term jobs; increases in hotel and restaurant use by nonlocal workers; purchase of materials, including cement and gravel; and services, such as equipment rental. Some long-term jobs may be created during operation, with ongoing spending on everything from turbine maintenance to plowing access roads in winter.

In 2013, the New York State Energy Research and Development Authority (NYSERDA) released a study 1 that analyzed the economic benefits resulting from New York State’s Renewable Portfolio Standard (RPS). This study analyzed three years of spending from 18 renewable energy facilities under contract to NYSERDA (including two biomass facilities, eight hydroelectric facility upgrades, and eight wind farms) and extrapolated direct investments over the lifecycle of the project. The research examined verified spending on jobs; payments to public entities; in-State purchases; and land leases for these facilities, from development and construction through the first three years of operation.

The study found that every megawatt-hour (MWh) of renewable energy generated under the RPS resulted in approximately $27 of direct investment (NYSERDA 2013). The bulk of the energy production and spending came from the wind farms, which included direct investment of $1 million/megawatt (MW) installed and $24/MWh for the eight projects analyzed.

Land Revenue

The development of a wind project can provide an additional source of income to rural land owners from leasing and royalty agreements. Since only a fraction of this land is utilized by physical plant structures and roads, the previous use of the land (e.g., farming or dairy operations) can continue alongside the wind power facility.

Depending on the placement of turbines on one or more properties, the project may directly benefit one or more landowners through lease payments and production royalties. In addition to these direct benefits, the broader community may benefit. This is due to multiplier effects associated with the increased income of the host landowners and long-term stability of those landowners, who have diversified their sources of income.

Property Taxes and Host Community Agreements

Wind energy projects typically contribute to local government revenues through tax collections or other local benefit agreements. When considering the different approaches or mechanisms used to establish payments to local governments, the magnitude of the payments should be comparable to the costs associated with additional services required by the project, while providing a reasonable benefit to the larger community. For many small towns, payments from wind energy projects result in a significant increase in revenue compared to other local revenue sources.

Some jurisdictions have limited or exempted local taxation of wind energy projects to induce development and increase economic diversity. Other forms of stimulus may include business or corporate incentives for establishing manufacturing or company headquarters in a region or state.

Wind Project Exemption

Payment of additional property taxes on improvements associated with wind turbines is exempt for a period of 15 years, unless opted-out by the local taxing jurisdiction (New York State Real Property Tax Law, §487). The current exemption law is set to expire on December 31, 2024. The exemption is at the discretion of the local taxing jurisdiction—while local taxing districts have generally granted the exemption, this has not always been the case.

Payments-in-Lieu-of-Taxes

County, city, town, village, and school district taxing jurisdictions that do not retract the exemption may enter into an agreement for payments-in-lieu-of-taxes (PILOTs) with the owner of the wind turbine equipment (project owner). PILOT agreements are common practice in all types of development projects, not just wind energy. Several taxing jurisdictions can be parties to the same agreement—each taxing jurisdiction does not have to enter into its own PILOT with the project owner. If multiple jurisdictions are parties to the agreement, the PILOT agreement defines the amount the project owner pays each taxing jurisdiction. Frequently, the county Industrial Development Agency (IDA) negotiates the PILOT on behalf of the relevant taxing jurisdictions. The agreements may be written by the county or local taxing jurisdiction’s tax counsel.

The payment amount is paid in lieu of property taxes due on the equipment and improvements to the land. PILOT amounts cannot exceed the amount that would be due if property taxes associated with the improvement were not exempt and the agreement cannot continue for more than 15 years. PILOT agreements negotiated through the county IDA can exceed this 15-year term. PILOT agreements cover the amount to be paid and how it is distributed among the different parties to the agreement, but do not include language on how these funds may be expended. After the agreement expires, the wind project owner is responsible for paying the property tax assessment required by the taxing jurisdictions. Wind project developers and taxing jurisdictions may want to estimate the potential future property taxes after the agreement expires, so wind developers and taxing jurisdictions can plan accordingly.

Property Value

Property owners often want to understand how a wind project will impact their property value. Depending on their involvement with a wind project, property owners usually have different concerns:

- Properties on which the wind project will be developed. Property owners usually lease their land to the wind developer and receive lease payments over the lifetime of the system. These payments can increase property values.

- Properties neighboring or in proximity to the wind project. Property owners are often concerned that the wind project will decrease their property values.

In general, only limited research on the impact of wind farms on property values is available. Such research examines trends in sales transactions. Data and studies for homes that are adjacent or are less than 0.5 miles from a wind project are rare. Because most large-scale wind farms are subject to setback requirements ensuring they are built a certain distance from neighboring properties, wind facilities are generally sited in areas with relatively few homes, limiting the number of sales transactions that are available for research (Hoen, Wiser, & Cappers, 2013).

The existing research examining the property values of residential homes located near or with views of wind turbines provides little or no evidence that home values are affected (positively or negatively) before or after the construction of facilities. For example, a study conducted by Hoen et al. in 2013, analyzed data from more than 50,000 home sales across 27 (mostly rural) counties in nine states including seven counties7 in New York that were within 0.5 to 10 miles of wind facilities. The study found no statistically significant evidence that home prices near wind turbines were affected in post-announcement, preconstruction, or post-construction periods. The study concluded that if effects do exist, the average impacts are relatively small (within the margin of error for the report, which was +/- 4.9% for homes within 1 to 10 miles, and +/- 9% for homes within .5 miles from a wind facility) and/or sporadic, impacting only a very small subset of homes.

A similar 2014 study examined 122,000 homes sales near 41 turbines located in more densely populated areas in Massachusetts within five miles of wind facilities. The study concluded there were no net effects on property values due to wind turbines. The study found only weak statistical evidence that the announcement of a wind facility had a modest adverse impact on home prices, and such impacts were no longer apparent after turbine construction and operation commenced (Hoen & Atkinson-Palombo, 2014).

Post a Comment:

You may also like:

Featured Articles

Environmental Impacts of Wind Industry

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...Wind Energy Cost Trends

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...Employment Impacts of Wind Industry

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...Challenges in Wind Industry

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...Economic Impacts of Wind Industry

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...