Home » News & Events » U.S. Offshore Wind Power Faces Uphill Battle

U.S. Offshore Wind Power Faces Uphill Battle

Recently, the U.S. Department of the Interior announced the approval of a commercial-scale offshore wind project, which is expected to be built off the coast of Massachusetts and will provide green power to more than 900,000 homes upon completion. Since the U.S. government first proposed the construction of commercial offshore wind farms has been more than two decades, as of now, the United States only in the beginning of this year put into operation the country's first commercial offshore wind farm. Although the U.S. government has repeatedly stressed that it will promote the development of the offshore wind industry, but high inflation and supply chain challenges are making the U.S. offshore wind industry is struggling.

Offshore Wind Power Bumpy Push

The U.S. Department of the Interior public statement shows that the above commercial-scale offshore wind power project plans for the installed capacity of 2,600 megawatts, is expected to install 129 units of offshore wind turbine generators, and up to 5 connecting the sea and land transmission lines.

According to Reuters, at the end of March, the U.S. Department of the Interior also approved the construction of a commercial offshore wind project in New York State.

In 2021, the U.S. government proposed to 2030 to complete the 30 GW offshore wind power installed target, offshore wind power in this regard is regarded as the U.S. government climate agenda as an important part. The U.S. Department of the Interior pointed out that, as of now, U.S. President Joe Biden's term of approval of offshore wind power project installed capacity of more than 10 gigawatts, if all to achieve the commissioning, enough for more than 4 million families to provide green power.

However, in fact, the start of the United States offshore wind power industry from the beginning of the development of decades later than Europe has been repeatedly frustrated. As early as 2001, the United States in Massachusetts planning the first commercial offshore wind power project, but the project was opposed by all parties had to be cancelled. Since then, the U.S. offshore wind power installed growth stagnated for many years, until 2016, Rhode Island only erected five offshore wind turbines, but its installed capacity has not yet reached the scale of commercial operation. Subsequent years, the U.S. East Coast, a number of offshore wind power project in the controversy of slow progress, until this year, the U.S. state of New York finally ushered in the country's first commercial-scale offshore wind farm.

Developer After Developer Retreat

In fact, the U.S. installed capacity of offshore wind power is far from enough to meet the target. According to the Global Wind Energy Council data, as of the second half of last year, the U.S. installed capacity of offshore wind power only 42 megawatts, during the same period of 938 megawatts of projects under construction. According to Bloomberg, as of October last year, the United States has only two offshore wind farms under construction, while there are two experimental offshore wind farms, the four offshore wind power project installed capacity adds up to less than 5 per cent of the United States 2030 installed capacity target.

More noteworthy is that, once actively involved in the development of offshore wind power in the United States a number of multinational energy developers, but also in the past few months frequently adjust the strategy, "sell" "exit" "cancellation" and other operations are endless.

To the United States, New York State Beacon Wind project and Empire Wind project, for example, these two projects previously by the two major European energy developers Equinor and bp joint venture construction, but by the impact of soaring costs, the two companies announced the cancellation of the Beacon Wind project with the State of New York signed a power supply agreement, at the same time Equinor announced the withdrawal from the development of the project, the same period of time , bp also withdrew from the Empire Wind project.

Equinor publicly explained the cancellation of the power supply agreement as a result of inflation, soaring interest rates and supply chain disruptions in the US offshore wind industry.

In addition to these two companies, Danish renewable energy giant Vosux announced last year that it was cancelling two major offshore wind projects in New Jersey, and Shell New Energy announced this year that it would sell the assets of a major offshore wind project in the United States. According to Bloomberg New Energy Finance, nearly 9 GW of offtake agreements in the US offshore wind sector have been cancelled in the past 12 months, accounting for 35% of all signed or awarded offtake agreements.

High Cost Challenges Continue

One of the big common reasons leading major energy developers to exit the U.S. offshore wind sector is the spiralling costs of U.S. offshore wind projects.

Last year, Avangrid, an energy developer that also chose to cancel a power supply agreement for a U.S. offshore wind project, noted in a statement that the U.S. offshore wind industry was facing "record economic inflation," "supply chain disruptions," "significant interest rate hikes" and "a significant increase in interest rates." "significant interest rate hikes," and that the combination of these factors will make it impossible to finance planned offshore wind projects under power supply contracts.

Bloomberg wrote that although the U.S. East Coast region has planned a number of offshore wind power projects, but with the cost of parts, raw material costs continue to rise, the cost of these projects has soared. According to Bloomberg New Energy Finance calculations, around 2021, the U.S. offshore wind power cost of electricity is also maintained at about 77 U.S. dollars / megawatt hour, which is the major offshore wind power project developers choose to sign a power sales agreement based on, and so far, in the economy under the impetus of high inflation, the U.S. offshore wind power cost of electricity has risen by 48 per cent, to 114 U.S. dollars / megawatt hour.

In the industry's view, to reach the established offshore wind power development goals, the U.S. government urgently need to make changes. Industry media Recharge quoted the U.S. Bureau of Ocean Energy Management offshore energy management official Megan Carr said, "Realistically speaking, in order to achieve the established offshore wind power installation goals, the U.S. offshore wind industry supply chain, ship supply, raw materials market need to be huge changes."

Global Wind Energy Council also pointed out that, from the industry's situation, the U.S. offshore wind industry not only has a cost crisis, but also the need for grid infrastructure planning and approval of reforms, further coordination of inter-regional planning, breaking the heavy obstacles in the process of construction of offshore wind power projects.

Offshore Wind Power Bumpy Push

The U.S. Department of the Interior public statement shows that the above commercial-scale offshore wind power project plans for the installed capacity of 2,600 megawatts, is expected to install 129 units of offshore wind turbine generators, and up to 5 connecting the sea and land transmission lines.

According to Reuters, at the end of March, the U.S. Department of the Interior also approved the construction of a commercial offshore wind project in New York State.

In 2021, the U.S. government proposed to 2030 to complete the 30 GW offshore wind power installed target, offshore wind power in this regard is regarded as the U.S. government climate agenda as an important part. The U.S. Department of the Interior pointed out that, as of now, U.S. President Joe Biden's term of approval of offshore wind power project installed capacity of more than 10 gigawatts, if all to achieve the commissioning, enough for more than 4 million families to provide green power.

However, in fact, the start of the United States offshore wind power industry from the beginning of the development of decades later than Europe has been repeatedly frustrated. As early as 2001, the United States in Massachusetts planning the first commercial offshore wind power project, but the project was opposed by all parties had to be cancelled. Since then, the U.S. offshore wind power installed growth stagnated for many years, until 2016, Rhode Island only erected five offshore wind turbines, but its installed capacity has not yet reached the scale of commercial operation. Subsequent years, the U.S. East Coast, a number of offshore wind power project in the controversy of slow progress, until this year, the U.S. state of New York finally ushered in the country's first commercial-scale offshore wind farm.

Developer After Developer Retreat

In fact, the U.S. installed capacity of offshore wind power is far from enough to meet the target. According to the Global Wind Energy Council data, as of the second half of last year, the U.S. installed capacity of offshore wind power only 42 megawatts, during the same period of 938 megawatts of projects under construction. According to Bloomberg, as of October last year, the United States has only two offshore wind farms under construction, while there are two experimental offshore wind farms, the four offshore wind power project installed capacity adds up to less than 5 per cent of the United States 2030 installed capacity target.

More noteworthy is that, once actively involved in the development of offshore wind power in the United States a number of multinational energy developers, but also in the past few months frequently adjust the strategy, "sell" "exit" "cancellation" and other operations are endless.

To the United States, New York State Beacon Wind project and Empire Wind project, for example, these two projects previously by the two major European energy developers Equinor and bp joint venture construction, but by the impact of soaring costs, the two companies announced the cancellation of the Beacon Wind project with the State of New York signed a power supply agreement, at the same time Equinor announced the withdrawal from the development of the project, the same period of time , bp also withdrew from the Empire Wind project.

Equinor publicly explained the cancellation of the power supply agreement as a result of inflation, soaring interest rates and supply chain disruptions in the US offshore wind industry.

In addition to these two companies, Danish renewable energy giant Vosux announced last year that it was cancelling two major offshore wind projects in New Jersey, and Shell New Energy announced this year that it would sell the assets of a major offshore wind project in the United States. According to Bloomberg New Energy Finance, nearly 9 GW of offtake agreements in the US offshore wind sector have been cancelled in the past 12 months, accounting for 35% of all signed or awarded offtake agreements.

High Cost Challenges Continue

One of the big common reasons leading major energy developers to exit the U.S. offshore wind sector is the spiralling costs of U.S. offshore wind projects.

Last year, Avangrid, an energy developer that also chose to cancel a power supply agreement for a U.S. offshore wind project, noted in a statement that the U.S. offshore wind industry was facing "record economic inflation," "supply chain disruptions," "significant interest rate hikes" and "a significant increase in interest rates." "significant interest rate hikes," and that the combination of these factors will make it impossible to finance planned offshore wind projects under power supply contracts.

Bloomberg wrote that although the U.S. East Coast region has planned a number of offshore wind power projects, but with the cost of parts, raw material costs continue to rise, the cost of these projects has soared. According to Bloomberg New Energy Finance calculations, around 2021, the U.S. offshore wind power cost of electricity is also maintained at about 77 U.S. dollars / megawatt hour, which is the major offshore wind power project developers choose to sign a power sales agreement based on, and so far, in the economy under the impetus of high inflation, the U.S. offshore wind power cost of electricity has risen by 48 per cent, to 114 U.S. dollars / megawatt hour.

In the industry's view, to reach the established offshore wind power development goals, the U.S. government urgently need to make changes. Industry media Recharge quoted the U.S. Bureau of Ocean Energy Management offshore energy management official Megan Carr said, "Realistically speaking, in order to achieve the established offshore wind power installation goals, the U.S. offshore wind industry supply chain, ship supply, raw materials market need to be huge changes."

Global Wind Energy Council also pointed out that, from the industry's situation, the U.S. offshore wind industry not only has a cost crisis, but also the need for grid infrastructure planning and approval of reforms, further coordination of inter-regional planning, breaking the heavy obstacles in the process of construction of offshore wind power projects.

Post a Comment:

You may also like:

Featured Articles

Economic Impacts of Wind Industry

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...Challenges in Wind Industry

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...Employment Impacts of Wind Industry

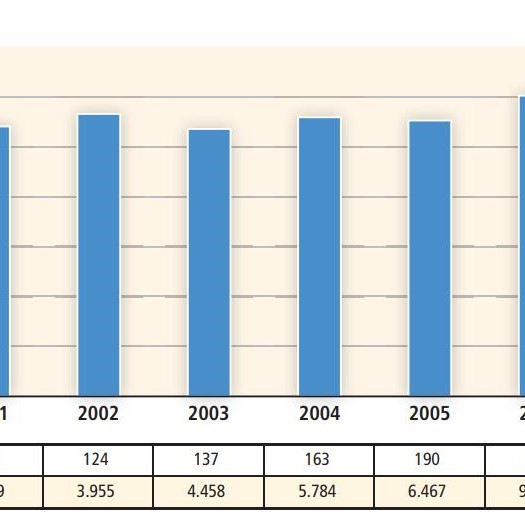

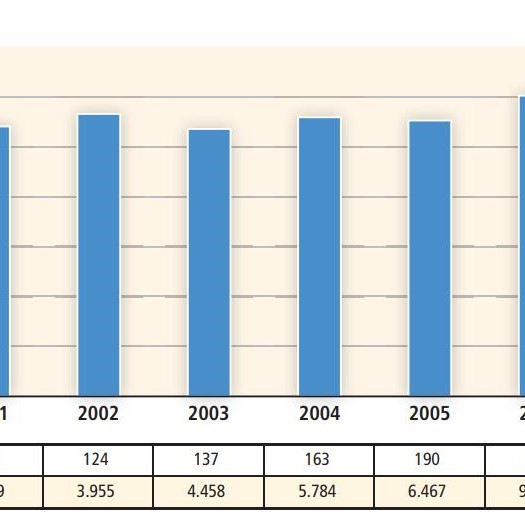

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...Environmental Impacts of Wind Industry

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...Wind Energy Cost Trends

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...